nebraska sales tax rate changes

LB 873 reduces the maximum tax rate of 684 for the income tax imposed on individuals and. Depending on local municipalities the.

Nebraska Income Tax Ne State Tax Calculator Community Tax

Simplify Nebraska sales tax compliance.

. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. This study recommended that business-to-business sales or business inputs be. Nebraska Department of Revenue.

In addition local sales and use taxes can be. Several local sales and use tax. A sales tax table is a printable sheet that you can use as a reference to easily calculate the.

Nebraska sales tax line 2 multiplied by 055. The County sales tax rate is. Complete Edit or Print Tax Forms Instantly.

This is the total of state. The Nebraska NE state sales tax rate is currently 55. The Nebraska state sales and use tax rate is 55 055.

Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. 55 Rate Card 6 Rate Card 65. The minimum combined 2022 sales tax rate for Norfolk Nebraska is.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is. Several local sales and use tax rate. Nebraska sales tax rate changes July 2019.

The Nebraska state sales and use tax rate is 55. 51 rows Form Title Form Document Nebraska Tax Application with Information Guide. The Nebraska sales tax rate is currently.

A new 1 local sales and use tax takes effect bringing the. Nebraska sales tax changes effective July 1 2019. 22 rows Raised from 7 to 75.

Choose Avalara sales tax rate tables by state or look up individual rates by address. Average Sales Tax With Local. 2 rows New rates were last updated on 712021.

Ad Access Tax Forms. Nebraska has state sales. Changes in Local Sales and Use Tax Rates Effective July 1 2021 No Changes.

Nebraska has a statewide sales tax rate of 55 which has been in place since 1967. Name address or ownership changes.

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

Nebraska Sales Tax Calculator And Local Rates 2021 Wise

Taxes And Spending In Nebraska

Sales Tax Laws By State Ultimate Guide For Business Owners

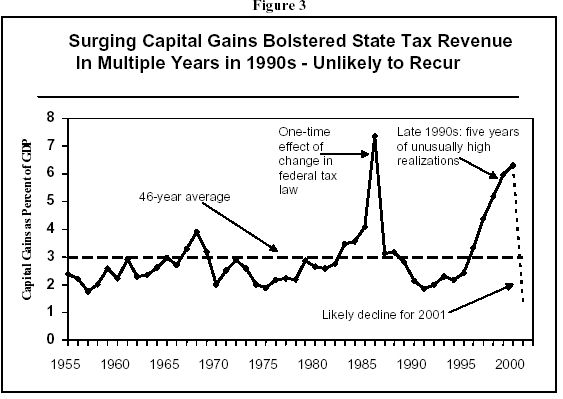

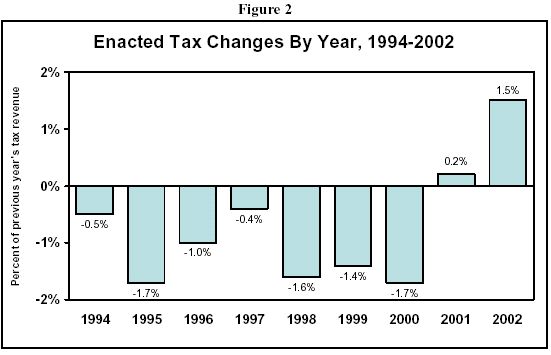

The State Tax Cuts Of The 1990s The Current Revenue Crisis And Implications For State Services 11 12 02

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Nebraska Sales Tax Small Business Guide Truic

The State Tax Cuts Of The 1990s The Current Revenue Crisis And Implications For State Services 11 12 02

Nebraska S Marketplace Facilitator Sales Tax Law Explained Taxjar

Taxes And Spending In Nebraska

Taxes And Spending In Nebraska

Sales Tax By State Is Saas Taxable Taxjar

State Sales Tax Rates Sales Tax Institute

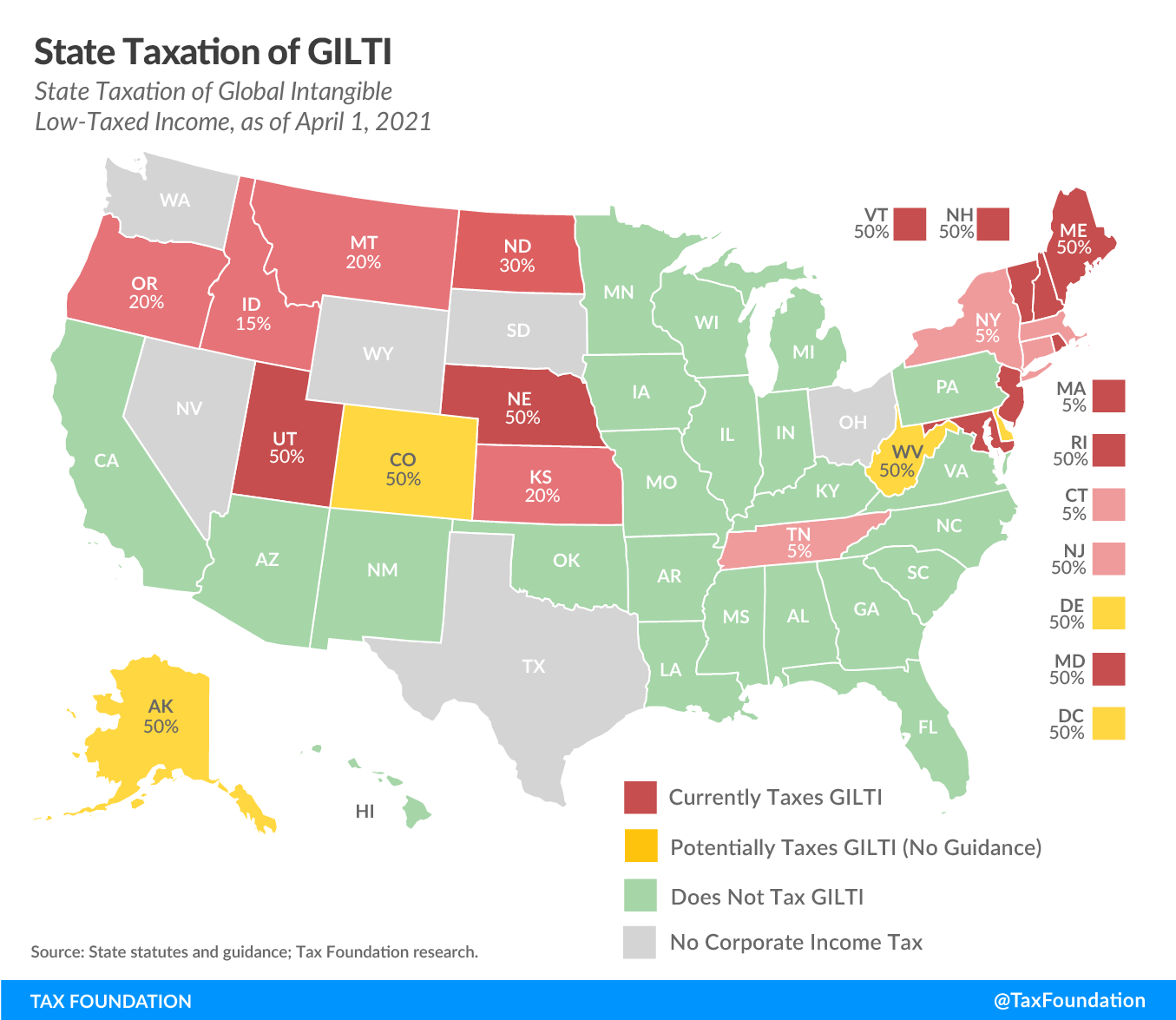

Nebraska Corporate Tax Bill Gilti And Corporate Rate Reduction

17 States With Estate Taxes Or Inheritance Taxes

What Is Sales Tax A Complete Guide Taxjar

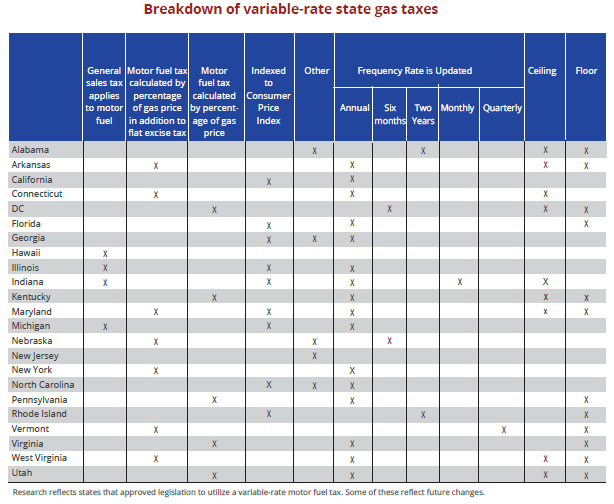

Variable Rate State Motor Fuel Taxes Transportation Investment Advocacy Center

Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare